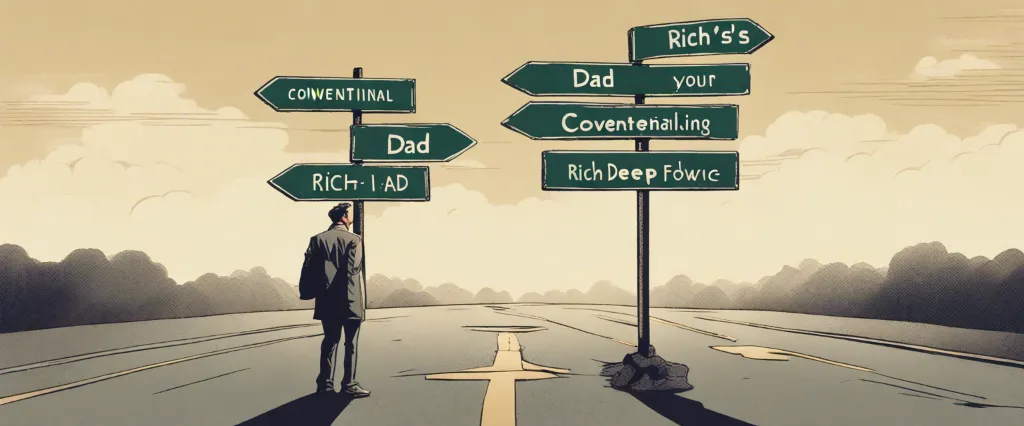

Interviewing Robert T. Kiyosaki, a renowned entrepreneur, investor, and bestselling author, is an opportunity to delve into the mind of a financial wizard who has made a significant impact on the way people perceive and approach money. With his groundbreaking book, “Rich Dad Poor Dad,” Kiyosaki challenged conventional wisdom and shared his unique insights into building wealth and achieving financial independence. As we sit down with him today, we are eager to uncover the secrets to his success and gain a deeper understanding of his perspectives on wealth creation, financial literacy, and entrepreneurship. Join us as we embark on an enlightening conversation with Robert T. Kiyosaki, a true maestro at turning dreams into reality and unlocking the doors to financial freedom.

Robert T. Kiyosaki is a renowned American author, entrepreneur, and financial expert who has captivated audiences worldwide with his powerful insights on financial literacy, wealth creation, and entrepreneurship. Born on April 8, 1947, in Hilo, Hawaii, Kiyosaki has become synonymous with his groundbreaking book “Rich Dad Poor Dad,” which not only changed the way people view money but also inspired millions to take control of their financial destiny. With a distinctive ability to demystify complex financial concepts, Kiyosaki has truly become an influential figure in the world of personal finance, motivating individuals from all walks of life to challenge conventional thinking and embrace a mindset of wealth creation.

10 Thought-Provoking Questions with Robert T. Kiyosaki

1. Can you provide ten Wisdom from Rich Dad Poor Dad by Robert T. Kiyosaki quotes to our readers?

1. “The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.”

2. “The rich focus on their asset columns while the poor focus on their income statements.”

3. “In the real world, the smartest people are people who make mistakes and learn. In school, the smartest people don’t make mistakes.”

4. “The poor and middle class work for money. The rich have money work for them.”

5. “The most life-destroying word of all is the word tomorrow.”

6. “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

7. “Without a strong reason or purpose, anything in life is hard.”

8. “The fear of being different prevents most people from seeking new ways to solve their problems.”

9. “Don’t be addicted to money. Work to learn. Don’t work for money. Work for knowledge.”

10. “Money comes and goes, but if you have the education about how money works, you gain power over it and can begin building wealth.”

“Rich Dad, Poor Dad” has indeed had a significant impact on readers worldwide by challenging conventional wisdom about money and wealth. The main lessons or principles from the book that have resonated most with readers are:

1. The importance of financial education: The book emphasizes the need to develop financial literacy and understanding. It encourages readers to learn about money, investments, and how it works in order to make informed financial decisions.

2. The concept of assets and liabilities: The distinction between assets and liabilities is crucial. The book teaches readers to invest in income-producing assets that put money in their pockets, rather than liabilities that take money out. This mindset shift is key to building wealth.

3. The power of cash flow: Building on the previous principle, the book emphasizes the significance of positive cash flow. It encourages readers to focus on generating passive income that exceeds their expenses, enabling financial independence.

4. Mindset and risk-taking: “Rich Dad, Poor Dad” highlights the importance of cultivating an entrepreneurial mindset and being open to taking calculated risks. It teaches readers to overcome fear and see failures as opportunities for growth.

Overall, the book’s main teachings inspire individuals to take control of their financial future, challenge societal norms, and pursue financial independence through education, investing wisely, and embracing a mindset that prioritizes assets and cash flow.

Financial literacy is crucial because it empowers individuals to make informed decisions and take control of their financial well-being. Without a solid understanding of financial concepts, individuals may find themselves trapped in perpetual debt or unable to build wealth.

To improve financial intelligence, individuals should first educate themselves about the difference between assets and liabilities. Assets are things that generate income or have the potential to appreciate in value, such as real estate or stocks. Liabilities, on the other hand, are expenses that drain money from our pockets, such as credit card debt or car loans.

Practical steps to improve financial intelligence include reading books on personal finance, attending seminars or workshops, and seeking guidance from knowledgeable mentors. Additionally, it is important to develop good financial habits like budgeting, saving, and investing wisely. Monitoring expenses, creating multiple streams of income, and continuously educating oneself about financial markets and opportunities are also critical.

By committing to financial education, individuals can develop the necessary skills to manage their money effectively, build wealth, and achieve financial independence. Financial literacy is a lifelong journey, and it requires consistent effort and discipline, but the rewards are invaluable.

The cash flow quadrant is a powerful framework introduced in “Rich Dad, Poor Dad” that classifies individuals into four distinct categories: employees (E), self-employed (S), business owners (B), and investors (I). Understanding this quadrant is essential for anyone seeking financial independence.

Employees and self-employed individuals are often trapped in a cycle of trading time for money, limiting their potential for wealth creation. The E and S quadrants are known for their linear income, which means earnings are directly tied to the number of hours worked. On the other hand, the B and I quadrants offer the potential for passive and residual income, allowing money to work for individuals, rather than the other way around.

Transitioning from the left side of the quadrant (E and S) to the right side (B and I) requires a shift in mindset and strategy. This usually involves acquiring financial education, seeking opportunities for asset acquisition, and taking calculated risks. By moving towards the B and I quadrants, individuals can build systems, such as starting a business or investing in income-generating assets, that generate income even when they are not actively working.

To successfully transition, it is crucial to develop financial literacy, embrace lifelong learning, network with successful individuals in the B and I quadrants, and take calculated risks that offer opportunities for higher returns. Ultimately, moving to the right side of the quadrant provides individuals with increased financial freedom, greater control over their time, and the potential for long-term wealth accumulation.

5.The book highlights the power of passive income and building assets that generate cash flow. Can you discuss the benefits of passive income and share strategies for individuals to start generating passive income streams?

6.”Rich Dad, Poor Dad” also addresses the mindset and beliefs around money and wealth. Can you discuss the importance of developing a wealth mindset and overcoming limiting beliefs about money?

7.The book encourages individuals to think like entrepreneurs and embrace opportunities for financial growth. Can you share practical tips for individuals to develop an entrepreneurial mindset and identify potential income-generating opportunities?

8.”Rich Dad, Poor Dad” discusses the role of financial independence and the concept of achieving financial freedom. Can you discuss what financial freedom means to you and provide guidance on how individuals can work towards achieving it?

9.The book also touches on the importance of financial risk and the potential rewards of taking calculated risks. Can you discuss the role of risk in building wealth and share strategies for individuals to manage and mitigate financial risks?

1. The Millionaire Next Door” by Thomas J. Stanley and William D. Danko – This book provides insights into the habits and characteristics of millionaires, emphasizing the importance of frugality, hard work, and smart financial decisions.

2. Think and Grow Rich” by Napoleon Hill – A classic self-help book that explores the mindset and principles necessary for achieving wealth and success, drawing on the experiences of successful individuals from Andrew Carnegie to Henry Ford.

3. The Intelligent Investor” by Benjamin Graham – Considered a must-read for anyone interested in stock market investing, this book delves into the philosophy and strategies of value investing, providing valuable lessons for making wise investment decisions.

4. The Richest Man in Babylon” by George S. Clason – Set in ancient Babylon, this book uses allegorical storytelling to impart timeless financial principles, teaching readers about saving, investing, and acquiring wealth effectively.

5. “Rich Dad’s CASHFLOW Quadrant” by Robert T. Kiyosaki – Although not the same as “Wisdom from Rich Dad Poor Dad,” this book by the same author explores the different ways people earn income and presents a roadmap for achieving financial independence by transitioning from the employee or self-employed quadrants to the business owner or investor quadrants.